Looking for the Mysterious Hedging Counterparty of Taiwan's Lifers

A reverse chron has a lot of advantages—but it isn’t the best way to present a series of posts meant to be read chronologically. I consequently wanted to pull together the blog posts that collectively laid out the argument I walked though on the recent Odd Lots podcast.

The first sets the stage by highlighting how Taiwan’s central bank doesn’t disclose its reserves using the standard global reporting template and notably doesn’t publish any data on its forward book. (Chapter 1 PDF)

More on:

The second highlights just how central portfolio outflows from the life insurers have become to Taiwan’s balance of payments, and underscores just how big their foreign currency balance sheet has become (and the various ways they get around the regulatory cap on their foreign assets). (Chapters 2 and 3 PDF)

The third is a short post walking through the various instruments life insurers and others use to hedge credit risk

The fourth asks if either foreign investors or Taiwan’s domestic banks could cover the life insurers hedging need ($250b in the backward looking data, likely rising toward $300b now). The short answer is they cannot, thought the banks do cover a portion of it. (Chapter 4 PDF)

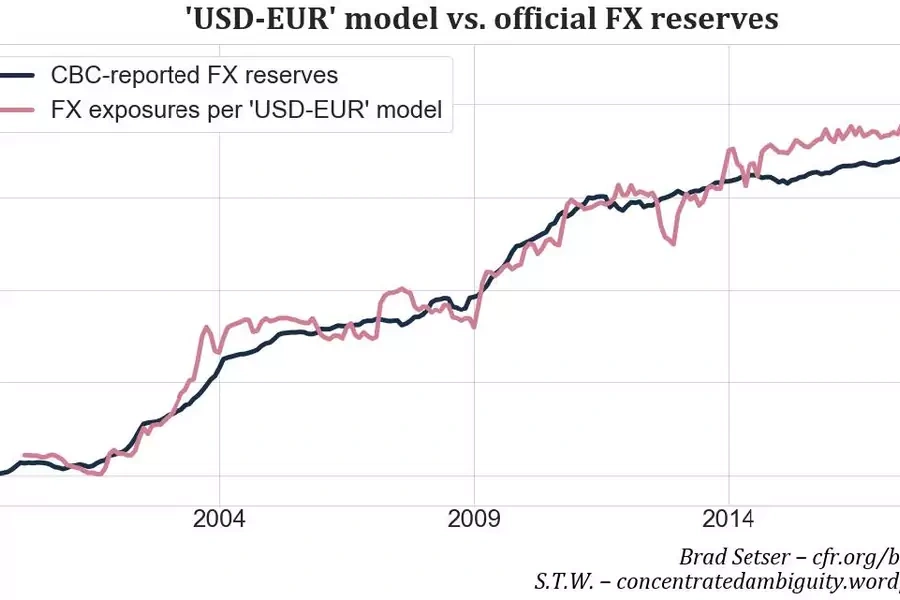

The fifth lays out the evidence that Taiwan’s central bank (the Central Bank of Republic of China) had a larger foreign asset position than it has disclosed—and that its net worth varies in a way that is consistent with a significant undisclosed swap book. (Chapter 5 PDF)

And the sixth more or less asks what does this all mean for Taiwan’s savers (who are taking on ever more FX risk), for the market (the swaps market as well as the foreign exchange market), and for Taiwan’s trading partners. Sustained large trade and current account surpluses have consequences. (Chapter 6 PDF)

More on:

I also want to thank my partner in this project, Concentrated Ambiguity. All the posts are cross-posted on his blog. He initially did the bulk of the analytical work than underlies the estimate of the Central Bank of China’s forward book.

Finally, I want to note that this project joins two long-standing interests of mine. The analysis is basically a modern application of the balance sheet approach— though the focus in this instance is on a creditor rather than on emerging market debtors. The key is following the connections across sectoral balance sheets—if the lifers are laying off foreign currency risk of close to 50 percent of Taiwan’s GDP, then who is on the other side? And the overall goal is to understand the post-2014 world where Asia’s savings glut is not, at least on the surface, intermediated through central bank balance sheets and thus private investors are taking on more and more of the currency risk associated with funding the U.S. current account deficit.

Online Store

Online Store